Introduction

In the world of personal finance, few concepts are as powerful as the future value of money. It underscores why starting early with retirement planning can turn modest contributions into a substantial nest egg. One key aspect of this is the future value of periodic investments—essentially, how regular deposits into an investment account grow over time thanks to compound interest. Whether you’re socking away money in a 401(k), IRA, or another retirement vehicle, understanding this can help you visualize your financial future and make informed decisions.

In the world of personal finance, few concepts are as powerful as the future value of money. It underscores why starting early with retirement planning can turn modest contributions into a substantial nest egg. One key aspect of this is the future value of periodic investments—essentially, how regular deposits into an investment account grow over time thanks to compound interest. Whether you’re socking away money in a 401(k), IRA, or another retirement vehicle, understanding this can help you visualize your financial future and make informed decisions.

The future value of money through periodic investments is one of the most compelling reasons to prioritize retirement planning early. Compound growth transforms regular, seemingly small contributions into significant wealth over decades. This principle is especially powerful in retirement vehicles like 401(k)s, IRAs, Roth IRAs, or even taxable brokerage accounts dedicated to long-term goals.

The Power of Compounding in Retirement Savings

Compounding is often called the eighth wonder of the world because it allows your money to earn returns on both the principal and accumulated interest. When you make periodic investments, like monthly payroll deductions into a 401(k), automatic transfers to an IRA, the effect multiplies dramatically over 20–40 years.

In retirement planning, most people don’t have large lump sums to invest upfront. If you have a lump sum to invest, check out this post. Instead, they rely on consistent contributions. Employer-sponsored plans frequently include matching contributions, which act like “free money” and supercharge growth. As of early 2026, data from major providers like Fidelity shows average total 401(k) savings rates (employee + employer) reaching record levels around 14.2–14.3%, with employee contributions at about 9.5% and employer matches at 4.8%. This is close to the often-recommended 15% savings rate for a secure retirement.

In retirement planning, most people don’t have large lump sums to invest upfront. If you have a lump sum to invest, check out this post. Instead, they rely on consistent contributions. Employer-sponsored plans frequently include matching contributions, which act like “free money” and supercharge growth. As of early 2026, data from major providers like Fidelity shows average total 401(k) savings rates (employee + employer) reaching record levels around 14.2–14.3%, with employee contributions at about 9.5% and employer matches at 4.8%. This is close to the often-recommended 15% savings rate for a secure retirement.

The earlier you start, the more time compounding has to work. Delaying by even a decade can require significantly higher contributions later to achieve similar results, due to lost compounding periods.

Understanding the Concept in Retirement Planning

In this expanded exploration, we’ll dive deeper into the mechanics, provide the core formula, an walk through a realistic example. By understanding these elements, you can make more informed decisions to secure a comfortable retirement.

Retirement planning often revolves around consistent saving and investing over decades. Instead of a one-time lump sum, most people make periodic investments, often automated monthly contributions from your paycheck of bank account. These payments benefit from compounding, where earnings generate more earnings over time. The future value of these periodic investments calculates how much these regular deposits will be worth at a future date, assuming a certain rate of return.

This is particularly relevant for retirement because it shows the power of discipline: small, steady investments can accumulate into hundreds of thousands (or millions) of dollars. Tools like employer-matched 401(k)s amplify this, but even without matches, the math works in your favor if you start young and stay consistent.

The Formula for Future Value of Periodic Investments

In a previous post, we discuss the “Future Value of Money: Future Value of Current Holdings”. This calculation utilizes its own formula. In this post, we’ll discuss for future value of money of future periodic investments. The sum of the two calculation will represent a reasonable estimate of your future portfolio.

In a previous post, we discuss the “Future Value of Money: Future Value of Current Holdings”. This calculation utilizes its own formula. In this post, we’ll discuss for future value of money of future periodic investments. The sum of the two calculation will represent a reasonable estimate of your future portfolio.

Even if you prefer to use a future value calculator, I would recommend that you work through the next section and the example that follows. Doing so will give you a better understanding of the importance of the rate of return and time.

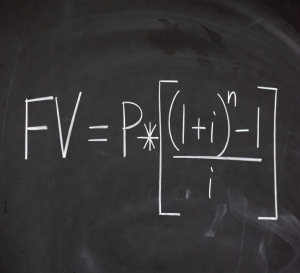

The standard formula for the future value of periodic investments is:

Where:

- FV represents the future value of the investment.

- P represents the amount of each periodic payment (usually annual or monthly contribution).

- r represents the rate of return per period (usually annual or monthly).

- n represents the total number of periods (usually years or months).

Compounding frequency matters. Monthly compounding (typical for retirement accounts) uses P = monthly investment, r = annual rate / 12, and n = years × 12.

Historical long-term averages for a diversified stock-heavy portfolio (e.g., tracking the S&P 500) hover around 10% nominal annual returns since the 1920s, though inflation-adjusted real returns are closer to 7%. Recent decades show variability: about 9–10% nominal over 30 years ending 2024, with higher figures in bull markets. Conservative projections often use 6–8% to account for fees, bonds in the mix, and future uncertainty.

A Practical Example

Let’s apply this formula to a retirement scenario. Suppose you’re 35 years old and plan to retire at 65, giving you 30 years (n = 30) of investing. You commit to depositing $300 per month into a diversified retirement account, assuming an average annual return of 7% (a common historical average for a balanced stock-bond portfolio). We’ll use monthly compounding for accuracy.

Plugging into the formula:

- P = $300 (per month)

- r = 0.07 / 12 ≈ 0.005833 (7% in the annual rate of return. It is divided by 12 to determine the monthly rate of return)

- n = 30 × 12 = 360 (30 year times 12 to determine the number of months)

The calculated future value is approximately $365,992.

This means your $300 monthly investments (totaling $108,000 in contributions over 30 years) could grow to over $365,000, thanks to compounding. That’s more than triple your input! Of course, this is a simplified projection, as real returns fluctuate, and fees or taxes could reduce the final amount. However, it illustrates why financial advisors stress starting early. A delay of 10 years results in a future value of only $156,270 and you’d need to invest much more monthly to catch up.

Risks in Retirement Investing

While the math is encouraging, real-world application involves substantial risks that can derail projections.

- Unrealistic Expectations and Market Volatility: As noted above, the average return of a portfolio made up of stock have averaged about 10% per year. However, theses returns are not seen year after year. This average is associated with unpredictable drops (-37% in 2008 and -18% in 2022) despite being up 73% of the time. Consider this volatility particularly if you are within 3 to 5 years of retirement. The shorter the period, the more likely your experience will be different. Your average returns, between now and retirement, might be less than the 10% long term average. This volatility can be moderated by diversifying your portfolio. It is best to be conservative in the estimates of your future average rate of return (“r’).

-

Inflation Risk (Including Sequence of Inflation): Inflation erodes purchasing power. If inflation spikes early in retirement (as seen in 2021–2023 periods), fixed withdrawals buy less over time. “Sequence of inflation risk” describes how higher inflation early compounds the erosion, even with steady returns. This is similar to sequence of returns risk.

-

Interest Rate and Bond Risks: Rising rates hurt bond values; in a higher-rate environment (post-2022), conservative allocations face headwinds.

-

Longevity Risk: Living longer than planned (e.g., to 95+) stretches savings thin. With increasing lifespans, many underestimate this.

-

Behavioral and Lifestyle Risks: Dipping into savings for emergencies, lifestyle creep, or market panic selling disrupts consistency. Automation helps, but life events intervene.

-

Tax, Fee, and Regulatory Risks: Taxes on withdrawals (traditional accounts), high fund fees (0.5–1%+ annually compound to huge losses), or policy changes affect outcomes.

Wrapping Up: Plan Today for Tomorrow

The future value of periodic investments is a game-changer for retirement planning, turning everyday savers into potential millionaires through the magic of compounding. Combine this growth with the growth of your current holdings. By using the formula, running examples like the one above, you can build a more secure financial future. Start small, stay consistent, and adjust as needed. If you’re just beginning, consider opening a retirement account today and automating those contributions. Start now. What’s your retirement strategy? Share in the comments.

The future value of periodic investments is a game-changer for retirement planning, turning everyday savers into potential millionaires through the magic of compounding. Combine this growth with the growth of your current holdings. By using the formula, running examples like the one above, you can build a more secure financial future. Start small, stay consistent, and adjust as needed. If you’re just beginning, consider opening a retirement account today and automating those contributions. Start now. What’s your retirement strategy? Share in the comments.

Final Thoughts: Action Today Shapes Tomorrow

The future value of periodic investments demonstrates that consistent action, not timing the market, builds wealth. With compounding, modest monthly habits can yield life-changing results. Yet success requires acknowledging risks—volatility, inflation, sequence effects—and planning defensively.

Calculate your own projections, increase savings if possible, and consult professionals for personalized advice. Commit to invest most of your future bonuses and raises. Your future retirement depends on decisions made today. What steps will you take next? Share your thoughts below!