You’ve probably heard it said that the first $100,000 is the hardest. It feels painfully slow. You save diligently, invest consistently, yet the balance crawls upward. Then, almost magically, once you cross that threshold, the next $100,000 arrives faster and faster. What looked impossible at first becomes inevitable.

This isn’t motivational fluff. It’s mathematics. Specifically, the mathematics of compound interest working on an ever-larger base.

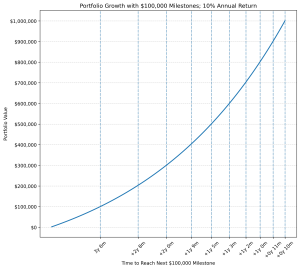

In this post, we’ll explore exactly why the first $100,000 feels like pushing a boulder uphill, while every subsequent $100,000 feels like the boulder has turned into a snowball rolling downhill. We’ll use a concrete example ($2,000 invested per month at a 10% annual return, compounded monthly) and break down the milestones. Don’t worry if you don’t have $2,000 a month to invest. It’s just an example. The concept of the “first $100,000” is the same regardless of the investment amount. We’ll reference visual evidence of the acceleration and discuss the real-world psychology, strategies, and caveats that matter for retirement planning.

The Power of Compound Interest: The Engine Behind the Shift

Compound interest is interest earned on both the money you put in and the interest it has already earned. Albert Einstein supposedly called it the “eighth wonder of the world.” Warren Buffett built Berkshire Hathaway on it.

Early on, your portfolio is tiny, so returns are tiny. At this early stage, most of your progress comes from new contributions. Once the portfolio grows large enough (maybe to first $100,000), returns begin to dominate contributions, sometimes by a wide margin. That’s when the time intervals between milestones begin to shrink dramatically.

Our Scenario: $2,000 per Month at 10% Annual Return

Let’s illustrate this phenomenon with an example. We chose a $2,000 per month invest to illustrate the point. Don’t be discouraged if you don’t have $2,000 per month to invest. The concept remains the same regardless of the investment amount. Only the timelines change.

Let’s illustrate this phenomenon with an example. We chose a $2,000 per month invest to illustrate the point. Don’t be discouraged if you don’t have $2,000 per month to invest. The concept remains the same regardless of the investment amount. Only the timelines change.

Let’s assume:

- You start with $0.

- You invest $2,000 at the end of every month.

- Annual return = 10% (historical average for a diversified stock portfolio).

- Compounding = monthly.

In this graph, the distance between the vertical dotted lines represents the amount of time to reach each subsequent $100,000 milestone. The first $100,000 takes approximately three and half years. The last $100,000 takes only ten months.

Here’s a different way to visualize the same information. You can clearly see the steadily decreasing amount of time it takes to acquire the next $100,000.

Why the First $100k Takes So Long (and Feels Even Longer)

- Your money hasn’t had time to work yet. At month 42 (the first $100,000), you’ve contributed roughly $84,000. The other $16,000 came from growth. Growth is doing only ~19% of the heavy lifting. After about sixteen and half years, your would have invested $396,000. Your portfolio would be worth $1,001,160. The growth is responsible for more than 60% of the portfolio balance. (See graph below.)

- Psychological drag. While this is certainly is a mathematical issue, psychology also plays a role. When your statement shows +$800 one month and the market drops 5% the next, it feels like you’re going nowhere. Early losses hurt more because the dollar amounts are small but the percentage swings feel huge relative to your effort.

- Opportunity cost of lifestyle. Saving $2,000/month while living on the remaining income often means driving an older car, skipping vacations, cooking at home, etc. The sacrifices are real and front-loaded.

Why It Accelerates So Dramatically After $100k

Once the portfolio is large, returns start out-earning contributions.

In our example:

- At $100k, 10% annual return = ~$833/month in growth (before new contributions).

- At $1M, ~$8,333/month.

Once you achieve $1,000,000, you’re still adding $2,000/month, but the portfolio itself is now generating more than four times that amount in expected growth. The snowball is rolling.

Real-World Considerations That Can Change the Timeline

- Inflation erodes purchasing power. $100k today won’t feel like $100k in 15 years. Adjust targets upward or focus on real returns (historically ~7% after inflation).

- Taxes and fees matter. Use tax-advantaged accounts (401(k), IRA, HSA). Keep expense ratios as low as possible (ex. Vanguard’s VTSAX’s expense ratio is 0.04%).

- Sequence risk — While sequence of returns risk is not an issue in the accumulation stage, it is a significant risk once you start withdrawing from your retirement accounts.

- Higher/lower contribution rates change absolute timelines but not the shape of acceleration. Someone saving $1,000/month will take roughly twice as long to hit each milestone, but the intervals will still shrink dramatically after the first $100,000.

- Variable returns — 10% is an average. Real markets deliver +30% years and –20% years. The math still holds over long periods.

Strategies to Reach the First $100k Faster (and Make the Rest Easier)

- Front-load savings aggressively in your 20s/30s. Every extra $10k you invest before age 40 can be worth $50k–$100k+ by retirement thanks to decades of compounding. A lump sum investment when you’re young can translate to huge sums in retirement.

- Contribute to Your 401K at Least Up to the Match. Contributing to your 401K is often match by your employer. Be sure to contribute at least up to the match percentage (usually 3%). This effectively doubles your investment and gets you to your goal faster.

- Increase income, not just cut expenses. Side hustles, career growth, and negotiating raises often move the needle faster than another $200/month in frugality. Try to invest as much of future raises and bonuses as possible.

- Automate everything. Set contributions to happen the day after payday. Treat saving like a non-negotiable bill. Make investing part of your written monthly budget.

- Rebalance and stay the course. The biggest risk to reaching $100,000 isn’t market volatility — it’s panic-selling during drawdowns.

The Psychological Battle: Staying Motivated When Progress Is Invisible

Track both contribution total and total portfolio value. Celebrate contribution milestones (“I just put in my 50th $2,000!”) even when the portfolio hasn’t moved much.

Reframe the narrative: “I’m buying shares of great companies at a discount during dips” instead of “My account is down $3k this month.”

Many people who hit the first $100,000 say the same thing: “It felt slow until it suddenly wasn’t.”

What Comes After $1 Million?

The same thing can be said about $1,000,000. “The first million is the hardest.” The grow graph of the first million looks like the graph for $100,000. The acceleration continues. At $2M, a 10% year adds $200k — more than most people save in an entire decade. At $5M, the same year adds $500k. This is why some retirees can safely withdraw 3–4% indefinitely while still growing the principal.

Final Thoughts

The first $100,000 is the hardest. It requires discipline, delayed gratification, and faith in a process whose biggest rewards are years away.

But once you’ve accumulated your first $100,000, the math starts working for you instead of against you. The time between milestones shrinks. The emotional weight lifts. What once felt like a grind becomes a virtuous cycle.

Start today. Even if your first contribution feels laughably small. Compound interest doesn’t care how big your starting number is — it only cares that you start, stay consistent, and give it time. Front load your investments if possible.

The first $100,000 is a bitch. But the second, third, and tenth? They practically show up on their own.

You’ve got this.